One of the most important factors in #DeFi Lending protocols is Liquidation. This is a system that must work well to protect both the platform and the user’s health.

Let’s dive into the details of Liquidation in Venus 👇

As soon as we deposit some assets (tokens) on the Venus protocol, we are entitled to receive interest (in deposited currency plus rewards paid in XVS). The Venus Protocol provides us with other options, in addition to interest on our tokens, we can take a loan using our asset as collateral for this loan.

This is a step-by-step guide on how to perform liquidations on the Venus Protocol. Liquidations involve seizing collateral from under-collateralized accounts to repay outstanding debts. The instructions are targeted towards developers or bots that aim to automate the liquidation process.

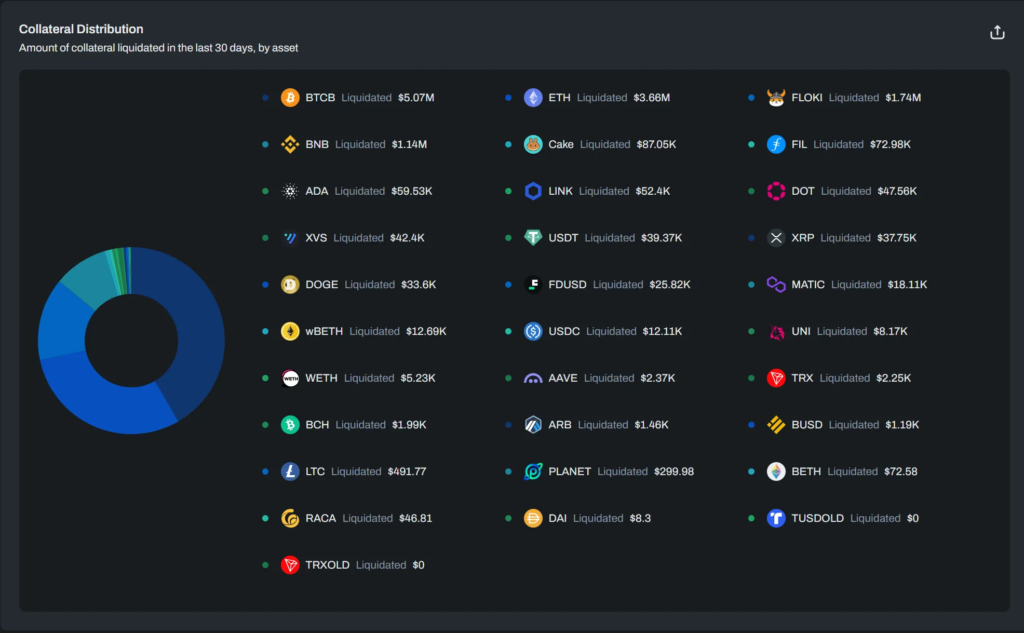

You can also monitor the Venus Protocol Risk Management/Liquidations via Chaoslabs :

Account Liquidity Calculations

Venus Protocol uses two calculations to determine account liquidity: Collateral Factor (CF) and Liquidation Threshold (LT).

Collateral Factor (CF)

Collateral Factor is the percentage of the supplied funds that can be used to cover a loan.

Liquidation Threshold (LT)

The Liquidation Threshold represents the point at which an account becomes under-collateralized, triggering the possibility of liquidation.

For each asset in the Venus protocol, there is a “Collateral Factor”, this indicates the maximum amount we can borrow against our collateral for that particular asset.

You should never let the loan limit reach 100%, because at that point, you can be liquidated.

If you use a volatile asset as collateral and also borrow it, you must carefully monitor your account, in case of significant market movements and react to them by adjusting the amount of the loan, etc. On the contrary, if the asset of collateral and of the loan are the same, the risk of liquidation in this case is almost zero. because the amount of your pledge and the loan in USD changes at the same time.

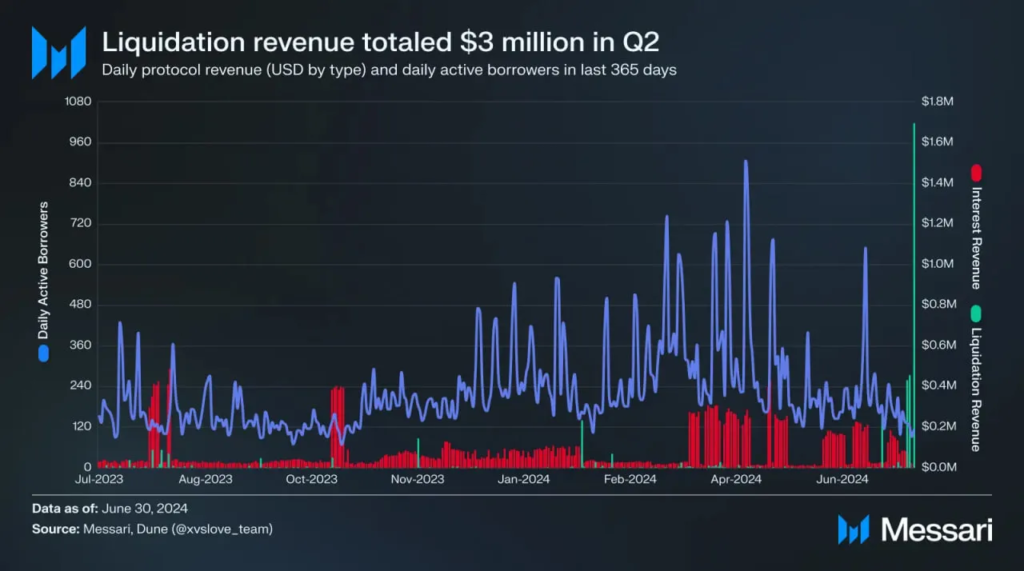

📌 In a visual from the Messari Q2 report below, you can see that even in a volatile period the Venus Liquidation system worked smoothly and was able to maintain the health of the Protocol and users accordingly.

You can also review the liquidation details on the Venus Dune page that Messari uses to report data.

Dune Data Platform : Venus Liquidations

“To Be Liquidated” ?

If the position is liquidated, this means that the liquidator is allowed to pay off the loan and is given the right to take over the collateral provided equal to the amount paid by the liquidator + 10% of this amount remaining as profit.

The liquidator liquidates a position sufficient to pay off the loan for a maximum of 50% of the value of the loan, which he immediately takes from the collateral, plus a liquidation fee of 10% (i.e. profit for the liquidator).

What Is Real Loss?

When a position is liquidated, technically its only loss is the 10% fee to the liquidator (now 5% to the liquidator and 5% as Protocol revenue).

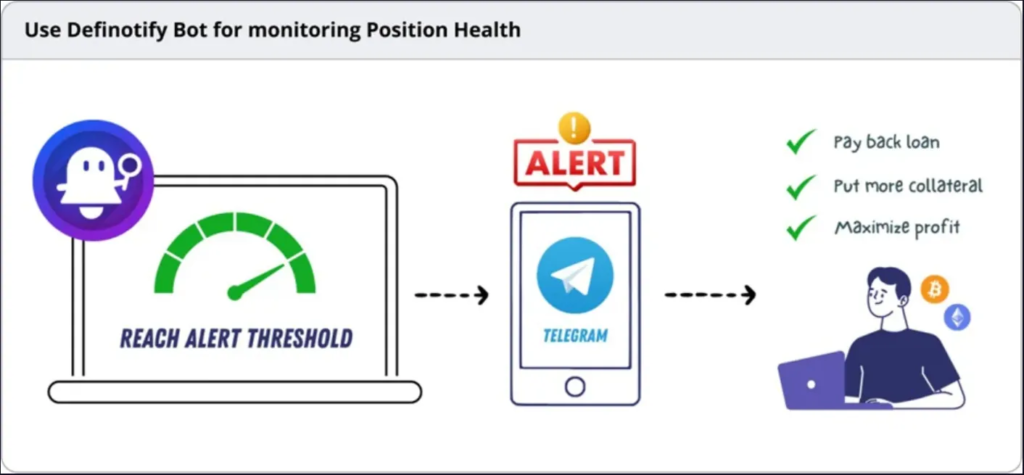

📌 Optimize risk and monitor your positions health on Venus with Crypto Notify Central

This collaboration will allow the Venus Community to use the #DeFiNotifyBot for 24/7 real-time notifications on Telegram to constantly be informed of their leveraged positions on Venus. This feature is designed to help users avoid over-leveraged positions that might lead to liquidation if not monitored closely.

You can access Vanguard Team’s guide to activating #DeFiNotifyBot on Venus at VenusStars.io

As long as you manage liquidation risk while using the Protocol, you can continue to enjoy the special privileges provided by DeFi and Venus…